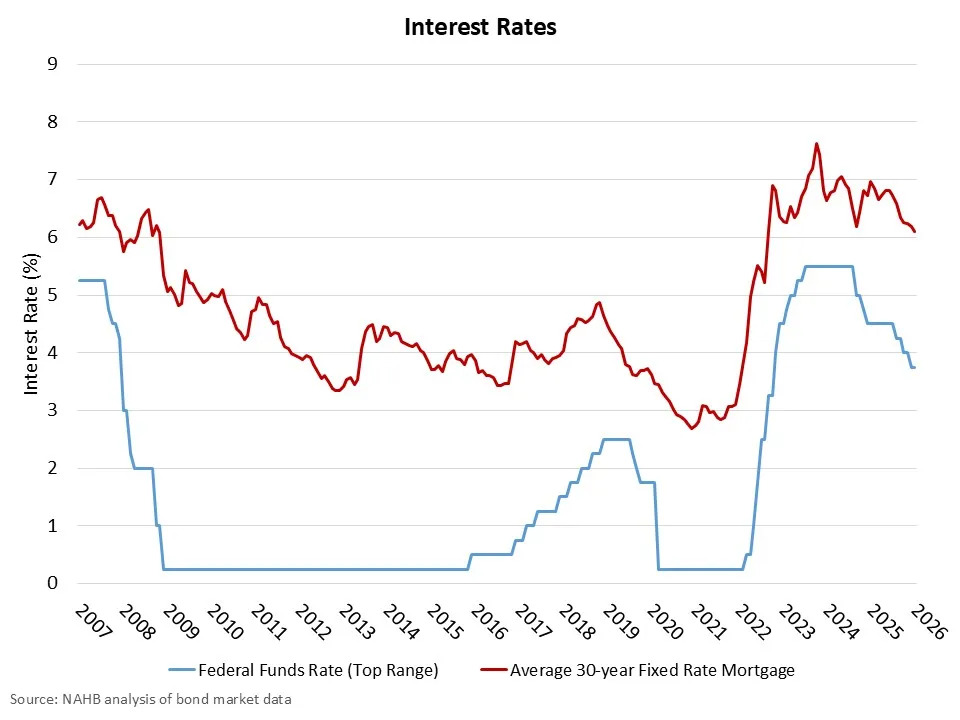

The Federal Reserve held rates steady at its January meeting, as inflation remains elevated at 2.7%. Economic growth remains in the good-not-great range, as the labor market showed clear signs of cooling during the second half of 2025. Such an economic backdrop would suggest continued easing for monetary policy.

The 10-year Treasury rate is near 4.25%, and the 30-year fixed-rate mortgage is approximately 6.1%. Mortgage rates moved lower last week on the prior announcement that Fannie and Freddie would acquire $200 billion in mortgage-backed securities (MBS) as part of the administration’s effort to improve housing affordability.

While most market analysts expect additional rate cuts from the Fed in 2026, the Fed may hold constant until a new chair is confirmed by the Senate. President Trump has appointed former Fed Governor Kevin Warsh as his pick to lead the Fed. Warsh is an institutional critic of the Fed, and in the past has held relatively hawkish, tight monetary policy views.

Despite his hawkish perspective, we expect Warsh to favor additional rate cuts under the view that productivity growth is increasing, which will act as a deflationary force ahead. And while Warsh has previously criticized the Fed’s expansion of its balance sheet (particularly MBS), we do not expect a big change in near-term policy given the Fed’s current, ample reserves strategy.

Further, we anticipate Warsh will increasingly favor less restrictive regulatory policy and oppose Fed actions in areas like climate and social policy that the Fed has stepped into in recent years. Future easing by the Fed — and potentially larger-than-expected tax refunds as part of tax filing season — should provide an economic boost moving into the spring.

Dr. Robert Dietz

NAHB Chief Economist

@dietz_econ

![SHBA [BLUE] SHBA [BLUE]](https://growthzonecmsprodeastus.azureedge.net/sites/910/2017/09/SHBA-BLUE.png)